Unrealized Sell Side Risk Ratio

What motivates a seller to sell? Using onchain data, the Unrealized Sell Side Risk Ratio aims to quantify the risk of significant selling.

Quantifying potential selling pressure

What motivates a seller to sell? Broadly speaking, sellers typically sell when they are in large profit or substantial loss. In essence, extreme profit and loss constitute a strong incentive to sell.

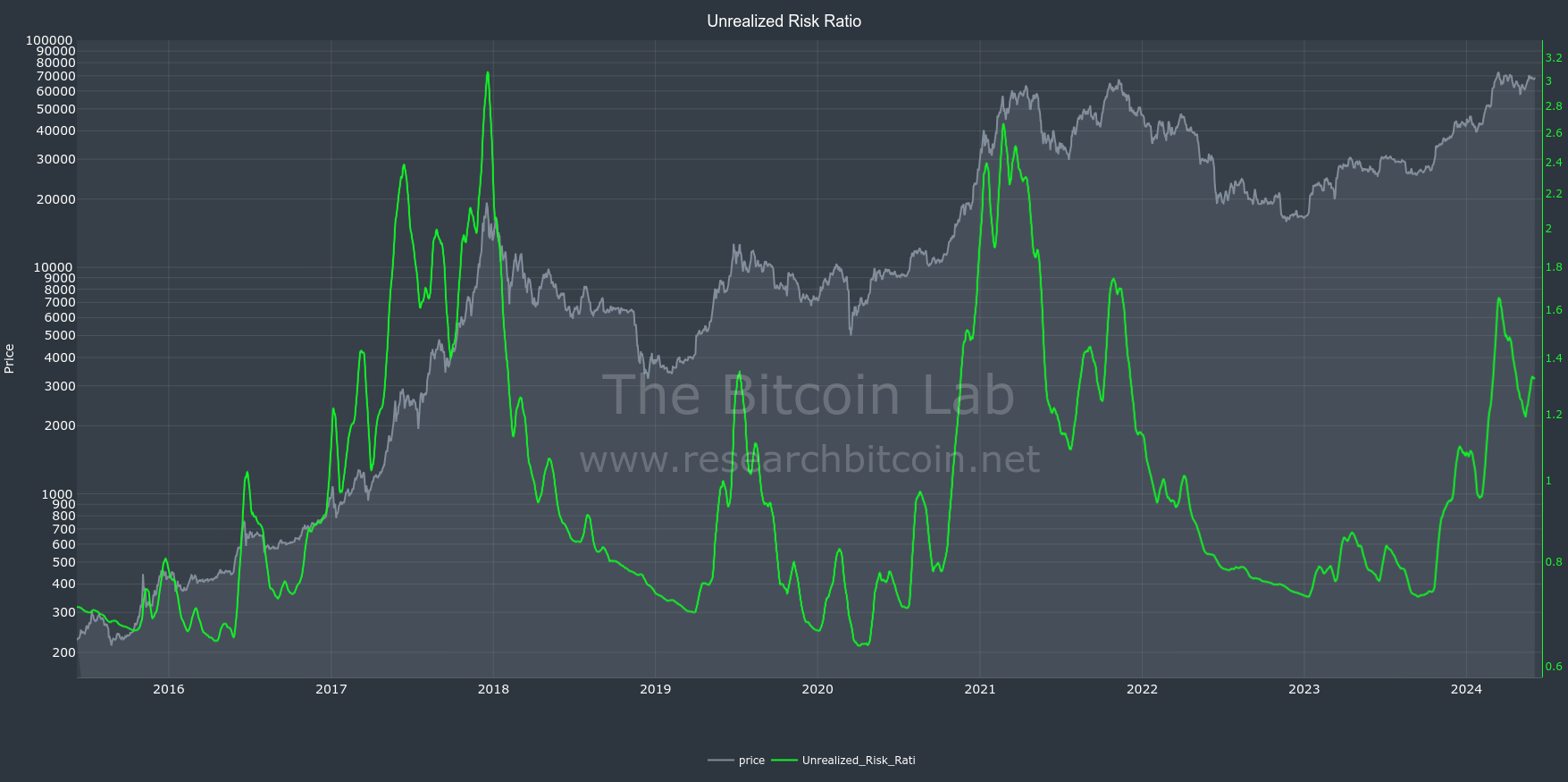

The Unrealized Sell Side Risk Ratio is an onchain metric that aims to quantify the risk of significant selling. Live version available in The Bitcoin Lab.

Onchain data is unique in its ability to estimate the cost basis of every coin in circulation, referred to as the realized price. By comparing the realized price of every coin with the current market price, one can calculate the unrealized profit and loss experienced by investors.

The potential selling pressure can be quantified as the sum of all unrealized profits and losses. Normalizing this sum with the realized capitalization allows the metric to be consistently compared across different time periods.

I am not aware of prior mentions of this distinct metric based on unrealized profit/loss. However, the idea and concept was originally proposed by Mikołaj Zakrzowski (@stacksmartly) for realized profit/loss (link at bottom of page) and he coined the metric Sell Side Risk Ratio. In The Bitcoin Lab, you can find both the Unrealized and Realized versions.

Formula

Unrealized Sell Side Risk Ratio is expressed as:

(UnRealizedProfit + UnRealizedLoss) / RealizedCap

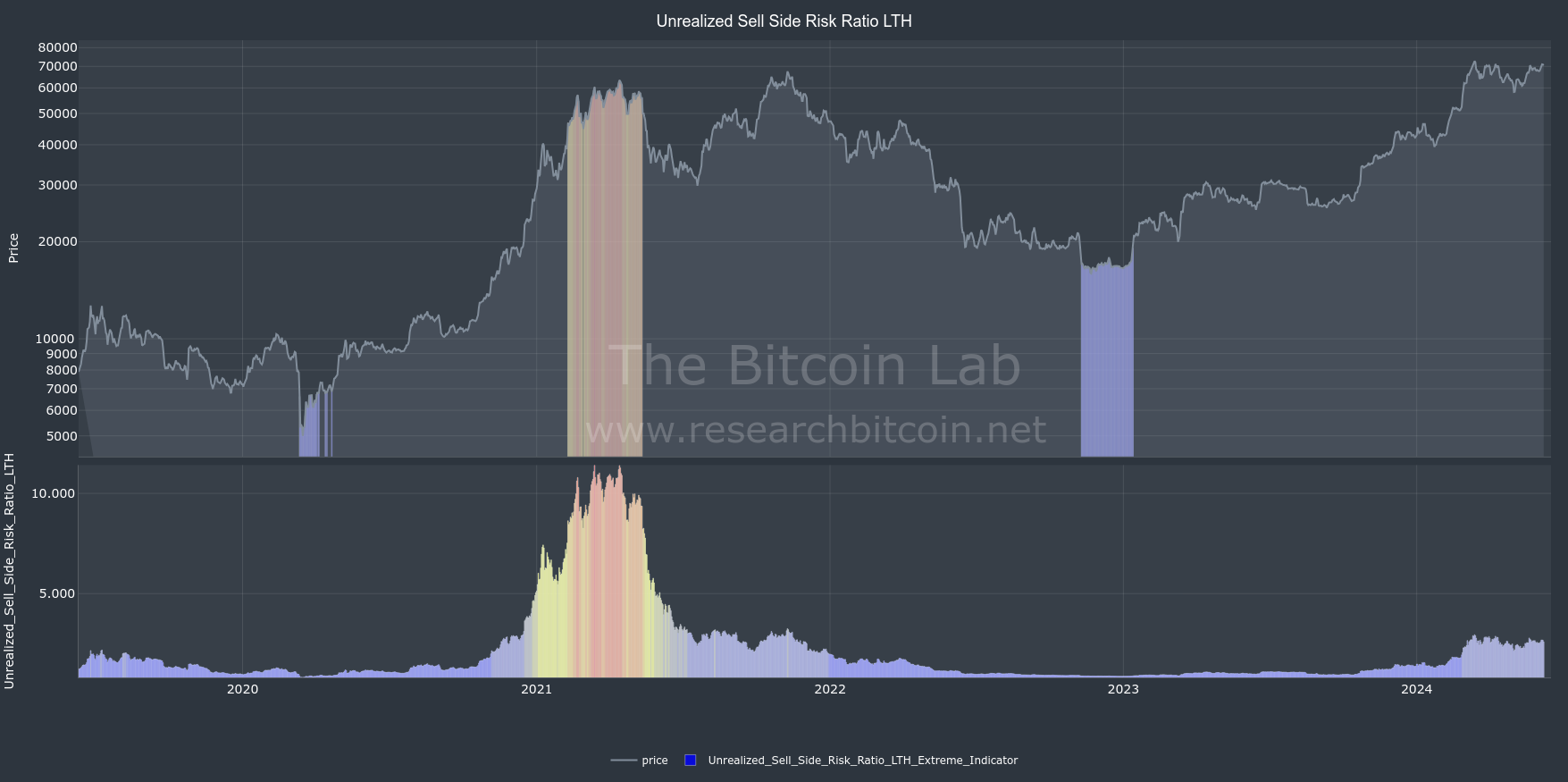

It is useful to study the Unrealized Sell Side Risk Ratio in various cohorts:

- Long Term Hodlers: Considers coins aged 155 days or more

- Short Term Hodlers: Considers coins aged less then 155 days

Interpretation

High values indicate that seller's are in extreme profit or loss. During such periods, the market can be considered unstable and prices are usually volatile as sellers begin to realize their profits or losses. The risk of a significant selling activity is very high.

Low values suggest that the current price conditions are not conducive to selling, either booking profits nor limiting losses. This scenario is commonly observed in stable, consolidating markets. These periods are characterized by low price volatility, which typically resolves eventually with a directional movement in prices, either upward or downward.

Notably, extremely low values may signify total seller exhaustion; the "there is no one left to sell" situation, marking capitulation events.

Application to investor cohorts

I recommend to analyze both the Long Term Hodler (LTH) and Short Term Hodler (STH) Unrealized Sell Side Risk Ratio to obtain a nuanced understanding of market dynamics.

The LTH cohort, representing core Bitcoin stakeholders, reflects a longer-term perspective. Conversely, STH is typically more speculative and with a shorter investment horizon, are generally the most price-sensitive. These two cohorts often have completely different incentives for selling which impacts their behavior.

Source

Discussed at X/twitter here: